Certificate in Finance & Accounting

This comprehensive certificate course contains all of the practical finance and accounting skills that you need to be successful from scratch. Upon completion of the course, students receive a Certificate in Finance and Accounting

Watch Promo

Welcome to the Certificate in Finance and Accounting course. By the end of this course, you will be armed with many tools and frameworks, so that you understand how accounting and finance works from scratch. Upon completion of the course, students receive a Certificate in Finance and Accounting.

Here are some of the many topics covered in this course:

·You will learn how to analyze public and private companies based on my work experience working at Goldman Sachs, hedge fund Citadel and based on my work experience in venture capital, companies I have started and based on my MBA in finance from Columbia University.

·You will learn how to forecast financial statements for public and private companies.

·You will learn how to create and manage a diversified investment portfolio like professional investors do.

·You will learn how to invest in stocks (long and short), bonds, commodities, real estate and even basic and advanced options.

·You will learn how to use my VFT framework, meaning valuation, fundamental, and technical analysis to make better long-term investment decisions.

Regardless of whether it's your own money, your clients' money, or corporate or government portfolios, this masterclass is so comprehensive and enjoyable, you can go from being financially illiterate to a savvy professional investor in practically no time at all with the methods that you'll learn to use in these easy to apply lessons.

In this comprehensive course I provide you with many downloadable frameworks that I built for you, so you can enjoy finance and accounting topics and analyze any company or build financial statements from scratch or do personal budgeting, et cetera, and so much more.

Course Structure and Downloadable Workbooks & Many Finance and Accounting Templates:

This 69 hour masterclass consists of four semesters of classes. In each semester, we have classes broken up into two or three topics and in all classes, attached you'll find a workbook in 3 different file formats that contain many frameworks and tools that you can use in order to take your finance or accounting skills to the next level!

The workbooks are in Google Docs format, another is in PDF format and another in Microsoft Word format, and all three have the exact same contents; please choose what workbook format works best for you, meaning Google Docs, Microsoft Word, or PDF. The workbooks contain links to many frameworks I created for you that you can download as well as optional resources and so much more.

The course is designed so that you can take it on a desktop, a laptop, a tablet, or even your cell phone - meaning an Android device, or an iOS device as well.

Here is an outline of what we cover in all 4 semesters in this comprehensive course:

Semester 1 of 4:

Class One

Topic 1: How Can We Build a Sales Focused Corporate Culture?

Topic 2: How Do CFOs & Heads of Sales Executives Quantify & forecast Sales?

Topic 3: How Can We Architect a More Advanced Excel Sales Dashboard (Without Coding)?

Class Two

Topic 1: Introduction to Accounting and Finance

Topic 2: New Introduction to The Balance Sheet

Topic 3: Creating Apple’s Balance Sheet

Class Three

Topic 1: Introduction to The Income Statement

Topic 2: The Relationship Between The Income Statement & The Balance Sheet

Topic 3: Creating Apple’s Income Statement

Class Four

Topic 1: How to Think Like a Bank Does

Topic 2: Introduction to The Cash Flow Statement

Topic 3: Creating Cowbell's Cashflow Statement

Class Five

Topic 1: Introduction to Investment Banking, The Initial Public Offering (IPO) and Mergers and Acquisitions (M&A)

Topic 2: The Anatomy of An IPO, The S-1 and The IPO Roadshow + The Anatomy of M&A Part 2

Topic 3: Investor Relations, 8-K, 10-Q, 10-K & The Earnings Call

Class Six

Topic 1: Introduction to The Sell Side, Trading Floors & Trading

Topic 2: Introduction to The V/F/T Investment Research Framework

Topic 3: How Does Technical Analysis Work?

Class Seven

Topic 1: Introduction to The Buy Side, Mutual Funds, Hedge Funds, Venture Capital and Private Equity Firms

Topic 2: Introduction to Valuation

Topic 3: P/E, P/B, P/R, Discounted Cash Flow (DCF) & EBITDA Multiples

Class Eight

Topic 1: Introduction to Financial Modeling (Predicting The Future & Being Comfortable With Uncertainty)

Topic 2: Synergies, Accretion & Dilution

Topic 3: Creating Our First Basic Financial Model & Target Price

Class Nine

Topic 1: Intro to Advanced Modeling & Valuation + 25 Best Practices for Modeling & Valuing Companies

Topic 2: Advanced Modeling of Financial Statements

Topic 3: Advanced Valuation

Class Ten

Topic 1: How to Come Up with Investment Ideas (Top Down Versus Bottoms Up Research)

Topic 2: My 8-Step Research Process

Topic 3: Using The VF and/or VFT Frameworks to Pick Investments

Class Eleven

Topic 1: Creating Value Investor Icon Warren Buffett’s Portfolio

Topic 2: Creating Growth Investor Icon William O’Neil’s Portfolio

Topic 3: ETFs, Bonds, REITs, Commodities

Semester 2 of 4

Class One

Topics 1-3: Saving [More] Money and Making Your Money Work for You

Class Two

Topic 1: Review of a Company’s Income Statement and Why It Is Similar to Our Own Income Statement

Topic 2: Save by Calculating Where Your Cash Is Going and Creating Your Current Income Statement

Topic 3: Creating Your New and Improved Income Statement

Class Three

Topic 1: Analyzing Your Personal Income Statement

Topic 2: Changing Your Perception of Money

Class Four

Topic 1: Analyzing Your B.S. (Balance Sheet) and Income Statement with Fun Math

Topic 2: Hiring a Financial Advisor and Or an Accountant to Help You with Your Money

Topic 3: Advanced Array Data Analysis and formula Construction

Class Five

Topic 1: Tax Strategies to Save You Money

Topic 2: Introduction to Tax forms and Filing Personal and Corporate Taxes

Topic 3: An Organized Paper Based Filing System for Managing Your Money

Class Six

Topic 1: Websites & Apps to Help You Track and Manage Your Personal Expenses

Topic 2: Investment Research Analysis on Intuit & Case Study of The Doj Blocking of Microsoft’s Hostile Acquisition of Intuit

Topic 3: Using Quicken Offline (Works In All Countries) With Our Filing System

Class Seven

Topic 1: Creating a Budget

Topic 2: Is Your $ Safe? Are Your Getting Ripped Off on Fees? Should You Switch Banks?

Topic 3: Wills, Trusts and Credit Scores

Class Eight

Topic 1: Introduction to Insurance

Topic 2: Identity Theft and Your Finances

Topic 3: Credit Cards, Loans and Leases

Class Nine

Topic 1: Profiles of Successful Wealthy People & How They Protect and Manage Their Money

Topic 2: Characteristics of Billionaires I Have Worked for

Topic 3: Why Is Warren Buffett So Successful?

Semester 3 of 4

Class One

Topic 1: Make More Money by Learning How to Avoid Paying High Investment Fees

Topic 2: Make More Money by Investing In

Topic 3: Data Analysis of ETFs Using Pivot Tables

Class Two

Topic 1: Introduction to Portfolio Management, Risk Management, Fixed Income and Yield Curves

Topic 2: Introduction to Your Excel Based Investment Portfolio Management System

Topic 3: Portfolio & Risk Management, Stock, Bond, Commodities, REITs & Diversification Exercises

Semester 4 of 4

Class One

Topic 1: Understanding The Power of The Time Value of Money & Your Money Work for You

Topics 2 and 3: Saving More Strategies

Class Two

Topic 1: Financial Research on Competition’s Valuation & Margins, Historical Growth)

Topic 2: Financial Research on Revenue forecast, Income Statement, Balance Sheet & Seasonality

Topic 3: Financial Research on Deferred Rev., P/E + P/R + DCF, Accounting Red Flags & Technicals)

Class Three

Topic 1: Building Your 100-150 Page Comprehensive Microsoft Word Research Report, Which Includes All 100 Steps

Topic 2: Building Your 1 Page Pdf Or Excel Research Report, Which Includes Highlights From All 100 Steps

Topic 3: Optional Topic Advanced Microsoft Excel Tips on How I Made The Spreadsheet

Class Four

Topic 1: Options and Stock Volatility, The Vix and More Steps

Topic 2: Valuation and Analysis of Options

Topic 3: 35+ Option Strategies

Get the confidence and tools you need to take your accounting and finance and investing career to the next level and join me in this comprehensive and fun course! : ) .

Thanks,

Chris Haroun

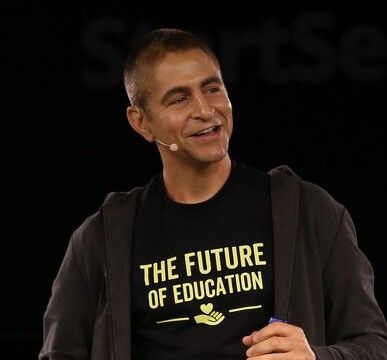

Your Instructor

Chris Haroun is the CEO & Founder of the Haroun MBA Degree Program®, a 400+ hour online business program. He has sold over 2,000,000 courses in 196 countries and has been featured in Business Insider, NBC, Forbes, CNN, Inc., and Entrepreneur.

A Columbia MBA graduate and former Goldman Sachs professional, Chris has raised and managed over $1 billion in his career. He has also worked at Citadel, Accenture, and multiple startups, including a firm that invested in Facebook pre-IPO.

As a business school professor and startup mentor, he has lectured at Stanford, Berkeley, and McGill, where he is a Dobson Fellow. His passion for education extends to philanthropy, focusing on building schools in Rwanda and funding scholarships worldwide.

Course Curriculum

-

StartWorkbook Attached for the Finance & Accounting Class #1 in PDF, Microsoft Word and in Google Docs Format

-

PreviewTopic 1: How Can We Build a Sales Focused Corporate Culture (a True Meritocracy)? (Part 1) (12:45)

-

StartTopic 1: How Can We Build a Sales Focused Corporate Culture (a True Meritocracy)? (Part 2) (12:50)

-

StartTopic 2: How Do CFOs & Heads Of Sales Executives Quantify & Forecast Sales? (Part 1) (14:25)

-

StartTopic 2: How Do CFOs & Heads Of Sales Executives Quantify & Forecast Sales? (Part 2) (8:24)

-

StartTopic 2: How Do CFOs & Heads Of Sales Executives Quantify & Forecast Sales? (Part 3) (11:28)

-

StartTopic 2: How Do CFOs & Heads Of Sales Executives Quantify & Forecast Sales? (Part 4) (15:48)

-

StartTopic 2: How Do CFOs & Heads Of Sales Executives Quantify & Forecast Sales? (Part 5) (16:45)

-

StartTopic 2: How Do CFOs & Heads Of Sales Executives Quantify & Forecast Sales? (Part 6) (17:11)

-

StartTopic 3: How Can We Architect A More Advanced Excel Sales Dashboard (Without Coding)? (17:11)

-

PreviewOptional Resource #1 to Watch after F.A.-1-1 Class: How to Use Excel (32:45)

-

PreviewOptional Resource #2 to Watch after F.A.-1-1 Class: How I Made the Main Menu Tab (Meaning the 1st Tab) (12:48)

-

StartOptional Resource #3 to Watch after F.A.-1-1 Class: How I Made the Sales Settings Tab (Meaning the 2nd Tab) (3:49)

-

StartOptional Resource #4 to Watch after F.A.-1-1 Class: How I Made the Sales Forecast Tab (Meaning the 3rd Tab) (8:36)

-

StartOptional Resource #5 to Watch after F.A.-1-1 Class: How I Made the Income Statement Tab (Meaning the 4th Tab) (7:12)

-

StartOptional Resource #6 to Watch after F.A.-1-1 Class: How I Made the Dashboard Tab (Meaning the 5th Tab) (3:17)

-

StartOptional Resource #7 to Watch after F.A.-1-1 Class: How I Made the 3D Buttons Images (10:41)

-

Start[Optional Lecture]: Questions and Answers for FA 1-1 (27:39)

-

StartQuiz for the First Finance and Accounting Class

-

StartWorkbook Attached for the Finance & Accounting Class #2 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Introduction to Accounting and Finance (14:28)

-

PreviewTopic 2: New Introduction to the Balance Sheet ( Part 1 ) (15:25)

-

StartTopic 2: New Introduction to the Balance Sheet ( Part 2 ) (20:45)

-

StartTopic 2: New Introduction to the Balance Sheet ( Part 3 ) (21:22)

-

PreviewTopic 3: Creating Apple’s Balance Sheet ( Part 1 ) (14:55)

-

StartTopic 3: Creating Apple’s Balance Sheet ( Part 2 ) (17:41)

-

StartTopic 3: Creating Apple’s Balance Sheet ( Part 3 ) (15:09)

-

Start[Optional Lecture]: Questions and Answers for FA 1-2 (27:39)

-

StartQuiz for the Second Finance & Accounting Class

-

StartWorkbook Attached for the Finance & Accounting Class #3 in PDF, Microsoft Word and in Google Docs Format

-

PreviewTopic 1: Introduction to the Income Statement ( Part 1 ) (22:03)

-

StartTopic 1: Introduction to the Income Statement ( Part 2 ) (21:29)

-

StartTopic 1: Introduction to the Income Statement ( Part 3 ) (24:14)

-

StartTopic 1: Introduction to the Income Statement ( Part 4 ) (18:39)

-

StartTopic 1: Introduction to the Income Statement ( Part 5 ) (22:41)

-

StartTopic 2: The Relationship the Income Statement & the Balance Sheet (6:36)

-

StartTopic 3: Creating Apple’s Income Statement ( Part 1 ) (19:33)

-

StartTopic 3: Creating Apple’s Income Statement ( Part 2 ) (21:43)

-

StartTopic 3: Creating Apple’s Income Statement ( Part 3 ) (22:28)

-

StartTopic 3: Creating Apple’s Income Statement ( Part 4 ) (19:16)

-

Start[Optional Lecture]: Questions and Answers for FA 1-3 (25:22)

-

StartQuiz for the Third Finance & Accounting Class

-

StartWorkbook Attached for the Finance & Accounting Class #4 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: How to Think Like a Bank Does (7:30)

-

PreviewTopic 2: Introduction to the Cash Flow Statement ( Part 1 ) (15:14)

-

StartTopic 2: Introduction to the Cash Flow Statement ( Part 2 ) (17:07)

-

StartTopic 3: Creating Cowbell's Cashflow Statement ( Part 1 ) (23:21)

-

StartTopic 3: Creating Cowbell's Cashflow Statement ( Part 2 ) (15:48)

-

Start[Optional Lecture]: Questions and Answers for FA 1-4 (Part 1) (16:46)

-

Start[Optional Lecture]: Questions and Answers for FA 1-4 (Part 2) (18:07)

-

StartQuiz for the Fourth Finance & Accounting Class

-

StartWorkbook Attached for the Finance & Accounting Class #5 in PDF, Microsoft Word and in Google Docs Format

-

PreviewTopic 1: Introduction to Investment Banking, The Initial Public Offering (IPO) and Mergers and Acquisitions (M&A) Part 1 (17:42)

-

StartTopic 1: Introduction to Investment Banking, The Initial Public Offering (IPO) and Mergers and Acquisitions (M&A) Part 2 (25:35)

-

StartTopic 1: Introduction to Investment Banking, The Initial Public Offering (IPO) and Mergers and Acquisitions (M&A) Part 3 (13:55)

-

StartTopic 2: The Anatomy of An IPO, The S-1 and The IPO Roadshow + The Anatomy of M&A Part 1 (22:51)

-

StartTopic 2: The Anatomy of An IPO, The S-1 and The IPO Roadshow + The Anatomy of M&A Part 2 (26:16)

-

StartTopic 2: The Anatomy of An IPO, The S-1 and The IPO Roadshow + The Anatomy of M&A Part 3 (24:36)

-

StartTopic 2: The Anatomy of An IPO, The S-1 and The IPO Roadshow + The Anatomy of M&A Part 4 (25:51)

-

StartTopic 3: Investor Relations, 8-K, 10-Q, 10-K & The Earnings Call (20:49)

-

Start[Optional Lecture]: Questions and Answers for FA 1-5 (Part 1) (16:33)

-

Start[Optional Lecture]: Questions and Answers for FA 1-5 (Part 2) (12:36)

-

StartQuiz for the Fifth Finance & Accounting Class

-

StartWorkbook Attached for the Finance & Accounting Class #6 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Introduction to The Sell Side, Trading Floors & Trading Part 1 (11:46)

-

StartTopic 1: Introduction to The Sell Side, Trading Floors & Trading Part 2 (23:41)

-

StartTopic 1: Introduction to The Sell Side, Trading Floors & Trading Part 3 (20:28)

-

StartTopic 2: Introduction to the V/F/T Investment Research Framework Part 1 (11:13)

-

StartTopic 2: Introduction to the V/F/T Investment Research Framework Part 2 (18:09)

-

StartTopic 3: How Does Technical Analysis Work? Part 1 (14:19)

-

StartTopic 3: How Does Technical Analysis Work? Part 2 (24:47)

-

Start[Optional Lecture]: Questions and Answers for FA 1-6 (Part 1) (19:21)

-

Start[Optional Lecture]: Questions and Answers for FA 1-6 (Part 2) (12:26)

-

StartQuiz for the Sixth Finance & Accounting Class

-

StartWorkbook Attached for the Finance & Accounting Class #7 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Introduction to The Buy Side, Mutual Funds, Hedge Funds, Venture Capital and Private Equity Firms (Part 1) (15:52)

-

StartTopic 1: Introduction to The Buy Side, Mutual Funds, Hedge Funds, Venture Capital and Private Equity Firms (Part 2) (13:22)

-

StartTopic 1: Introduction to The Buy Side, Mutual Funds, Hedge Funds, Venture Capital and Private Equity Firms (Part 3) (9:42)

-

StartTopic 1: Introduction to The Buy Side, Mutual Funds, Hedge Funds, Venture Capital and Private Equity Firms (Part 4) (13:00)

-

StartTopic 1: Introduction to The Buy Side, Mutual Funds, Hedge Funds, Venture Capital and Private Equity Firms (Part 5) (15:15)

-

StartTopic 1: Introduction to The Buy Side, Mutual Funds, Hedge Funds, Venture Capital and Private Equity Firms (Part 6) (8:51)

-

StartTopic 2: Introduction to Valuation (9:11)

-

StartTopic 3: P/E, P/B, P/R, Discounted Cash Flow (DCF) & EBITDA Multiples (Part 1) (13:55)

-

StartTopic 3: P/E, P/B, P/R, Discounted Cash Flow (DCF) & EBITDA Multiples (Part 2) (15:04)

-

StartTopic 3: P/E, P/B, P/R, Discounted Cash Flow (DCF) & EBITDA Multiples (Part 3) (10:31)

-

Start[Optional Lecture]: Questions and Answers for FA 1-7 (Part 1) (16:34)

-

Start[Optional Lecture]: Questions and Answers for FA 1-7 (Part 2) (14:00)

-

StartQuiz for the Seventh Finance & Accounting Class

-

StartWorkbook Attached for the Finance & Accounting Class #8 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Introduction to Financial Modelling (Predicting the Future & Being Comfy with Uncertainty) Part 1 (14:10)

-

StartTopic 1: Introduction to Financial Modelling (Predicting the Future & Being Comfy with Uncertainty) Part 2 (11:42)

-

StartTopic 1: Introduction to Financial Modelling (Predicting the Future & Being Comfy with Uncertainty) Part 3 (16:25)

-

StartTopic 1: Introduction to Financial Modelling (Predicting the Future & Being Comfy with Uncertainty) Part 4 (18:31)

-

StartTopic 2: Synergies, Accretion & Dilution (14:33)

-

StartTopic 3: Creating Our First Basic Financial Model & Target Price (Part 1) (12:54)

-

StartTopic 3: Creating Our First Basic Financial Model & Target Price (Part 2) (14:39)

-

StartTopic 3: Creating Our First Basic Financial Model & Target Price (Part 3) (13:59)

-

StartTopic 3: Creating Our First Basic Financial Model & Target Price (Part 4) (11:19)

-

StartTopic 3: Creating Our First Basic Financial Model & Target Price (Part 5) (11:16)

-

StartTopic 3: Creating Our First Basic Financial Model & Target Price (Part 6) (9:18)

-

StartTopic 3: Creating Our First Basic Financial Model & Target Price (Part 7) (9:27)

-

StartTopic 3: Creating Our First Basic Financial Model & Target Price (Part 8) (11:28)

-

StartTopic 3: Creating Our First Basic Financial Model & Target Price (Part 9) (10:55)

-

StartTopic 3: Creating Our First Basic Financial Model & Target Price (Part 10) (18:47)

-

Start[Optional Lecture]: Questions and Answers for FA 1-8 (21:57)

-

StartQuiz for the Eighth Finance & Accounting Class

-

StartWorkbook Attached for the Finance & Accounting Class #9 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Intro to Advanced Modeling & Valuation + 25 Best Practices for Modeling & Valuing Companies (Part 1) (18:48)

-

StartTopic 1: Intro to Advanced Modeling & Valuation + 25 Best Practices for Modeling & Valuing Companies (Part 2) (30:17)

-

StartTopic 1: Intro to Advanced Modeling & Valuation + 25 Best Practices for Modeling & Valuing Companies (Part 3) (27:29)

-

StartTopic 2 (Part 1 of 2): Advanced Modeling of Financial Statements (Part 1) (22:54)

-

StartTopic 2 (Part 1 of 2): Advanced Modeling of Financial Statements (Part 2) (22:54)

-

StartTopic 2 (Part 1 of 2): Advanced Modeling of Financial Statements (Part 3) (24:10)

-

Start[Optional Lecture]: Questions and Answers for FA 1-9_Part 1 (20:20)

-

StartQuiz for the Ninth Finance & Accounting Class PART 1/2

-

StartWorkbook IS NOT Attached (Use the Same Workbook as the Previous Class)

-

StartTopic 2 (Part 2 of 2): Advanced Modeling of Financial Statements (Part 1) (22:03)

-

StartTopic 2 (Part 2 of 2): Advanced Modeling of Financial Statements (Part 2) (25:25)

-

StartTopic 2 (Part 2 of 2): Advanced Modeling of Financial Statements (Part 3) (20:32)

-

StartTopic 3: Advanced Valuation (Part 1) (20:53)

-

StartTopic 3: Advanced Valuation (Part 2) (21:27)

-

StartTopic 3: Advanced Valuation (Part 3) (18:14)

-

StartTopic 3: Advanced Valuation (Part 4) (19:57)

-

Start[Optional Lecture]: Questions and Answers for FA 1-9_Part 2 (22:17)

-

StartQuiz for the Ninth Finance & Accounting Class PART 2/2

-

StartWorkbook Attached for the Finance & Accounting Class #10 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: How to Come Up with Investment Ideas (Top Down Versus Bottoms Up Research) Part 1 (10:53)

-

StartTopic 1: How to Come Up with Investment Ideas (Top Down Versus Bottoms Up Research) Part 2 (16:32)

-

StartTopic 1: How to Come Up with Investment Ideas (Top Down Versus Bottoms Up Research) Part 3 (11:02)

-

StartTopic 1: How to Come Up with Investment Ideas (Top Down Versus Bottoms Up Research) Part 4 (12:06)

-

StartTopic 1: How to Come Up with Investment Ideas (Top Down Versus Bottoms Up Research) Part 5 (8:33)

-

StartTopic 2: My 8-Step Research Process (8:09)

-

StartTopic 3: Using the VF and/or VFT Frameworks to Pick Investments (Part 1) (12:45)

-

StartTopic 3: Using the VF and/or VFT Frameworks to Pick Investments (Part 2) (15:55)

-

StartTopic 3: Using the VF and/or VFT Frameworks to Pick Investments (Part 3) (15:35)

-

StartTopic 3: Using the VF and/or VFT Frameworks to Pick Investments (Part 4) (14:47)

-

StartTopic 3: Using the VF and/or VFT Frameworks to Pick Investments (Part 5) (13:41)

-

StartTopic 3: Using the VF and/or VFT Frameworks to Pick Investments (Part 6) (12:18)

-

Start[Optional Lecture]: Questions and Answers for FA 1-10 (24:27)

-

StartQuiz for the Tenth Finance & Accounting Class

-

StartWorkbook Attached for the Finance & Accounting Class #11 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Creating Value Investor Icon Warren Buffett’s Portfolio ( Part 1) (18:25)

-

StartTopic 1: Creating Value Investor Icon Warren Buffett’s Portfolio ( Part 2) (22:42)

-

StartTopic 1: Creating Value Investor Icon Warren Buffett’s Portfolio ( Part 3) (19:26)

-

StartTopic 1: Creating Value Investor Icon Warren Buffett’s Portfolio ( Part 4) (19:24)

-

StartTopic 2: Creating Growth Investor Icon William O’Neil’s Portfolio (24:02)

-

StartTopic 3: ETFS, Bonds, REITS, Commodities ( Part 1) (18:50)

-

StartTopic 3: ETFS, Bonds, REITS, Commodities ( Part 2) (23:50)

-

Start[Optional Lecture]: Questions and Answers for FA 1-11 (28:12)

-

StartQuiz for the Eleventh Finance & Accounting Class

-

StartWorkbook Attached for the Finance & Accounting Class #1 of Semester 2 PART 1/2 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Saving [MORE] Money and Making Your Money Work for You (Part 1) (19:25)

-

StartTopic 1: Saving [MORE] Money and Making Your Money Work for You (Part 2) (21:19)

-

StartTopic 1: Saving [MORE] Money and Making Your Money Work for You (Part 3) (17:32)

-

StartTopic 1: Saving [MORE] Money and Making Your Money Work for You (Part 4) (15:31)

-

StartTopic 1: Saving [MORE] Money and Making Your Money Work for You (Part 5) (15:24)

-

StartTopic 1: Saving [MORE] Money and Making Your Money Work for You (Part 6) (19:04)

-

StartTopic 2: 132 Ways to Save Money (Numbers 1 Through 49) (Part 1) (16:02)

-

StartTopic 2: 132 Ways to Save Money (Numbers 1 Through 49) (Part 2) (18:25)

-

StartTopic 2: 132 Ways to Save Money (Numbers 1 Through 49) (Part 3) (17:13)

-

StartTopic 2: 132 Ways to Save Money (Numbers 1 Through 49) (Part 4) (15:59)

-

StartTopic 2: 132 Ways to Save Money (Numbers 1 Through 49) (Part 5) (17:05)

-

Start[Optional Lecture]: Questions and Answers for FA 2-1_Part 1 (23:28)

-

StartQuiz for the Finance & Accounting Class #1 (PART 1/2) of Semester Two

-

StartWorkbook IS NOT Attached (Use the Same Workbook as the Previous Class)

-

StartTopic 2: 132 Ways to Save Money (Numbers 1 Through 49) (Part 6) (17:01)

-

StartTopic 2: 132 Ways to Save Money (Numbers 1 Through 49) (Part 7) (16:34)

-

StartTopic 3: 132 Ways to Save Money (Numbers 50 Through 132) (Part 1) (21:16)

-

StartTopic 3: 132 Ways to Save Money (Numbers 50 Through 132) (Part 2) (19:58)

-

StartTopic 3: 132 Ways to Save Money (Numbers 50 Through 132) (Part 3) (25:07)

-

StartTopic 3: 132 Ways to Save Money (Numbers 50 Through 132) (Part 4) (20:04)

-

StartTopic 3: 132 Ways to Save Money (Numbers 50 Through 132) (Part 5) (18:56)

-

StartTopic 3: 132 Ways to Save Money (Numbers 50 Through 132) (Part 6) (27:13)

-

Start[Optional Lecture]: Questions and Answers for FA 2-1_Part 2 (29:00)

-

StartQuiz for the Finance & Accounting Class #1 (PART 2/2) of Semester Two

-

StartWorkbook Attached for the Finance & Accounting Class #2 of Semester 2 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Review of A Company’s Income Statement and Why It Is Similar to Our Own Income Statement (Part 1) (19:11)

-

StartTopic 1: Review of A Company’s Income Statement and Why It Is Similar to Our Own Income Statement (Part 2) (19:33)

-

StartTopic 2: Save by Calculating Where Your Cash is Going and Creating Your CURRENT Income Statement (Part 1) (21:09)

-

StartTopic 2: Save by Calculating Where Your Cash is Going and Creating Your CURRENT Income Statement (Part 2) (16:11)

-

StartTopic 2: Save by Calculating Where Your Cash is Going and Creating Your CURRENT Income Statement (Part 3) (16:25)

-

StartTopic 2: Save by Calculating Where Your Cash is Going and Creating Your CURRENT Income Statement (Part 4) (14:48)

-

StartTopic 3: Creating Your NEW+IMPROVED Income Statement (Part 1) (14:43)

-

StartTopic 3: Creating Your NEW+IMPROVED Income Statement (Part 2) (17:21)

-

StartTopic 3: Creating Your NEW+IMPROVED Income Statement (Part 3) (19:40)

-

StartTopic 3: Creating Your NEW+IMPROVED Income Statement (Part 4) (15:16)

-

Start[Optional Lecture]: Questions and Answers for FA 2-2 (26:39)

-

StartQuiz for the Finance & Accounting Class #2 of Semester Two

-

StartSaving Strategies Part 1 of 17: Save on Taxes: 14 Ways to Save More on Taxes (26:30)

-

StartSaving Strategies Part 2 of 17: Save on Car & Transportation: 13 Ways to Save More on Car/Transportation Expenses (21:38)

-

StartSaving Strategies Part 3 of 17: Save on Child/Child Care: 5 Ways to Save More on Child/Child Care Expenses (19:52)

-

StartSaving Strategies Part 4 of 17: Save on Communications/Computer: 6 Ways to Save More on Phone/Computer Expenses (14:29)

-

StartSaving Strategies Part 5 of 17: Save on Debt Payments: 7 Ways to Save More on Debt Expenses (11:50)

-

StartSaving Strategies Part 6 of 17: Save on Education: 4 Ways to Save More on Education Expenses (5:26)

-

StartSaving Strategies Part 7 of 17: Save on Entertainment: 7 Ways to Save More on Entertainment Expenses (13:43)

-

StartSaving Strategies Part 8 of 17: 6 Ways to Save More on Fees Expenses (7:33)

-

StartSaving Strategies Part 9 of 17: Save on Food & Drinks: 13 Ways to Save More on Food & Drinks Expenses (20:05)

-

StartSaving Strategies Part 10 of 17: Save on Gifts & Donations: 4 Ways to Save More on Gifts & Donation Expenses (11:00)

-

StartSaving Strategies Part 11 of 17: Save on Health/Fitness/Life Insurance: 4 Ways to Save More on Health Expenses (4:35)

-

StartSaving Strategies Part 12 of 17: Save on Housing: 10 Ways to Save More on Housing Expenses (16:36)

-

StartSaving Strategies Part 13 of 17: Save on Personal Care: 5 Ways to Save More on Personal Care Expenses (29:26)

-

StartSaving Strategies Part 14 of 17: Save on Pets: 5 Ways to Save More on Pet Related Expenses (3:01)

-

StartSaving Strategies Part 15 of 17: Save on Shopping: 17 Ways to Save More on Shopping Expenses (15:33)

-

StartSaving Strategies Part 16 of 17: Save on Vacation: 5 Ways to Save More on Vacation Expenses (3:12)

-

StartSaving Strategies Part 17 of 17: Save on Other Expenses: 8 Ways to Save More on Other Expenses (8:37)

-

StartWorkbook Attached for the Finance & Accounting Class #3 of Semester 2 PART 1/2 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Analyzing Your Personal Income Statement (Part 1) (14:08)

-

StartTopic 1: Analyzing Your Personal Income Statement (Part 2) (20:39)

-

StartTopic 1: Analyzing Your Personal Income Statement (Part 3) (19:50)

-

StartTopic 1: Analyzing Your Personal Income Statement (Part 4) (21:34)

-

StartTopic 1: Analyzing Your Personal Income Statement (Part 5) (18:40)

-

Start[Optional Lecture]: Questions and Answers for FA 2-3_Part 1 (25:48)

-

StartQuiz for the Finance & Accounting Class #3 (PART 1/2) of Semester Two

-

StartWorkbook IS NOT Attached (Use the Same Workbook as the Previous Class)

-

StartTopic 2: Changing Your Perception of Money (Part 1) (18:02)

-

StartTopic 2: Changing Your Perception of Money (Part 2) (17:55)

-

StartTopic 2: Changing Your Perception of Money (Part 3) (15:42)

-

StartTopic 2: Changing Your Perception of Money (Part 4) (18:09)

-

StartTopic 3: Introduction to Protecting Your Money & Creating Your Personal Balance Sheet (Part 1) (20:37)

-

StartTopic 3: Introduction to Protecting Your Money & Creating Your Personal Balance Sheet (Part 2) (18:35)

-

Start[Optional Lecture]: Questions and Answers for FA 2-3_Part 2 (11:13)

-

StartQuiz for the Finance & Accounting Class #3 (PART 2/2) of Semester Two

-

StartWorkbook Attached for the Finance & Accounting Class #4 of Semester 2 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Analyzing Your B.S. (Balance Sheet) And Income Statement with Fun Math (Part 1) (16:28)

-

StartTopic 1: Analyzing Your B.S. (Balance Sheet) And Income Statement with Fun Math (Part 2) (21:12)

-

StartTopic 1: Analyzing Your B.S. (Balance Sheet) And Income Statement with Fun Math (Part 3) (21:04)

-

StartTopic 1: Analyzing Your B.S. (Balance Sheet) And Income Statement with Fun Math (Part 4) (18:18)

-

StartTopic 1: Analyzing Your B.S. (Balance Sheet) And Income Statement with Fun Math (Part 5) (17:02)

-

StartTopic 2: Hiring A Financial Advisor and Or an Accountant to Help You with Your Money (Part 1) (15:05)

-

StartTopic 2: Hiring A Financial Advisor and Or an Accountant to Help You with Your Money (Part 2) (19:05)

-

StartTopic 3: Advanced Array Data Analysis and Formula Construction (Part 1) (19:12)

-

StartTopic 3: Advanced Array Data Analysis and Formula Construction (Part 2) (18:21)

-

StartTopic 3: Advanced Array Data Analysis and Formula Construction (Part 3) (15:42)

-

StartTopic 3: Advanced Array Data Analysis and Formula Construction (Part 4) (13:57)

-

Start[Optional Lecture]: Questions and Answers for FA 2-4 (16:36)

-

StartQuiz for the Finance & Accounting Class #4 of Semester Two

-

StartWorkbook Attached for the Finance & Accounting Class #5 of Semester 2 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Tax Strategies to Save You Money (Part 1) (21:29)

-

StartTopic 1: Tax Strategies to Save You Money (Part 2) (22:25)

-

StartTopic 1: Tax Strategies to Save You Money (Part 3) (15:18)

-

StartTopic 1: Tax Strategies to Save You Money (Part 4) (21:57)

-

StartTopic 1: Tax Strategies to Save You Money (Part 5) (11:26)

-

StartTopic 1: Tax Strategies to Save You Money (Part 6) (20:33)

-

StartTopic 2: Introduction to Tax Forms and Filing Personal and Corporate Taxes (Part 1) (23:02)

-

StartTopic 2: Introduction to Tax Forms and Filing Personal and Corporate Taxes (Part 2) (22:42)

-

StartTopic 3: An Organized Paper Based Filing System for Managing Your Money (Part 1) (15:28)

-

StartTopic 3: An Organized Paper Based Filing System for Managing Your Money (Part 2) (13:37)

-

Start[Optional Lecture]: Questions and Answers for FA 2-5 (Part 1) (17:02)

-

Start[Optional Lecture]: Questions and Answers for FA 2-5 (Part 2) (22:35)

-

StartQuiz for the Finance & Accounting Class #5 of Semester Two

-

StartWorkbook Attached for the Finance & Accounting Class #6 of Semester 2 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Websites & Apps to Help You Track and Manage Your Personal Expenses (Part 1) (18:04)

-

StartTopic 1: Websites & Apps to Help You Track and Manage Your Personal Expenses (Part 2) (12:33)

-

StartTopic 2: Investment Research Analysis on Intuit & case study of the DOJ Blocking of Microsoft’s Hostile Acquisition of Intuit (Part 1) (15:31)

-

StartTopic 2: Investment Research Analysis on Intuit & case study of the DOJ Blocking of Microsoft’s Hostile Acquisition of Intuit (Part 2) (22:34)

-

StartTopic 2: Investment Research Analysis on Intuit & case study of the DOJ Blocking of Microsoft’s Hostile Acquisition of Intuit (Part 3) (13:49)

-

StartTopic 3: Using Quicken Offline (Works in All Countries) with Our Filing System (Part 1) (22:40)

-

StartTopic 3: Using Quicken Offline (Works in All Countries) with Our Filing System (Part 2) (20:49)

-

Start[Optional Lecture]: Questions and Answers for FA 2-6 (Part 1) (16:15)

-

Start[Optional Lecture]: Questions and Answers for FA 2-6 (Part 2) (23:45)

-

StartQuiz for the Finance & Accounting Class #6 of Semester Two

-

StartWorkbook Attached for the Finance & Accounting Class #7 of Semester 2 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Creating a Budget (Part 1) (18:15)

-

StartTopic 1: Creating a Budget (Part 2) (15:23)

-

StartTopic 1: Creating a Budget (Part 3) (20:06)

-

StartTopic 2: Is Your $ Safe? Are Your Getting Ripped off on Fees? Should You Switch Banks? (Part 1) (17:45)

-

StartTopic 2: Is Your $ Safe? Are Your Getting Ripped off on Fees? Should You Switch Banks? (Part 2) (19:34)

-

StartTopic 2: Is Your $ Safe? Are Your Getting Ripped off on Fees? Should You Switch Banks? (Part 3) (11:58)

-

StartTopic 3: Wills, Trusts and Credit Scores (Part 1) (24:32)

-

StartTopic 3: Wills, Trusts and Credit Scores (Part 2) (19:21)

-

StartTopic 3: Wills, Trusts and Credit Scores (Part 3) (19:03)

-

StartTopic 3: Wills, Trusts and Credit Scores (Part 4) (20:08)

-

StartTopic 3: Wills, Trusts and Credit Scores (Part 5) (19:40)

-

Start[Optional Lecture]: Questions and Answers for FA 2-7 (24:35)

-

StartQuiz for the Finance & Accounting Class #7 of Semester Two

-

StartWorkbook Attached for the Finance & Accounting Class #8 of Semester 2 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Introduction to Insurance (Part 1) (16:36)

-

StartTopic 1: Introduction to Insurance (Part 2) (17:52)

-

StartTopic 1: Introduction to Insurance (Part 3) (15:30)

-

StartTopic 1: Introduction to Insurance (Part 4) (17:14)

-

StartTopic 1: Introduction to Insurance (Part 5) (15:48)

-

StartTopic 1: Introduction to Insurance (Part 6) (14:08)

-

StartTopic 2: Identity Theft and Your Finances (20:10)

-

StartTopic 3: Credit Cards, Loans and Leases (Part 1) (13:12)

-

StartTopic 3: Credit Cards, Loans and Leases (Part 2) (12:21)

-

Start[Optional Lecture]: Questions and Answers for FA 2-8 (20:47)

-

StartQuiz for the Finance & Accounting Class #8 of Semester Two

-

StartWorkbook Attached for the Finance & Accounting Class #9 of Semester 2 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Profiles of Successful Wealthy People & How they Protect and Manage Their Money Part 1 (15:15)

-

StartTopic 2: Characteristics of Billionaires I Have Worked For (Part 1) (16:18)

-

StartTopic 2: Characteristics of Billionaires I Have Worked For (Part 2) (14:08)

-

StartTopic 3: Why is Warren Buffett So Successful? (Part 1) (17:16)

-

StartTopic 3: Why is Warren Buffett So Successful? (Part 2) (17:38)

-

StartTopic 3: Why is Warren Buffett So Successful? (Part 3) (17:48)

-

StartTopic 3: Why is Warren Buffett So Successful? (Part 4) (19:24)

-

StartTopic 3: Why is Warren Buffett So Successful? (Part 5) (19:27)

-

Start[Optional Lecture]: Questions and Answers for FA 2-9 (26:40)

-

StartQuiz for the Finance & Accounting Class #9 of Semester Two

-

StartWorkbook Attached for the Finance & Accounting Class #1 of Semester 3 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Make More Money by Learning How to Avoid Paying High Investment Fees (Part 1) (20:53)

-

StartTopic 1: Make More Money by Learning How to Avoid Paying High Investment Fees (Part 2) (11:27)

-

StartTopic 2: Make More Money by Investing in ETFs (Part 1) (19:23)

-

StartTopic 2: Make More Money by Investing in ETFs (Part 2) (23:51)

-

StartTopic 2: Make More Money by Investing in ETFs (Part 3) (16:16)

-

StartTopic 2: Make More Money by Investing in ETFs (Part 4) (14:45)

-

StartTopic 3: Data Analysis of ETFs Using Pivot Tables (Part 1) (11:30)

-

StartTopic 3: Data Analysis of ETFs Using Pivot Tables (Part 2) (17:22)

-

Start[Optional Lecture]: Questions and Answers for FA 3-1 (23:00)

-

StartQuiz for the Finance & Accounting Class #1 of Semester Three

-

StartWorkbook Attached for the Finance & Accounting Class #2 of Semester 3 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Introduction to Portfolio Management, Risk Management, Fixed Income and Yield Curves (Part 1) (17:41)

-

StartTopic 1: Introduction to Portfolio Management, Risk Management, Fixed Income and Yield Curves (Part 2) (16:32)

-

StartTopic 1: Introduction to Portfolio Management, Risk Management, Fixed Income and Yield Curves (Part 3) (20:08)

-

StartTopic 1: Introduction to Portfolio Management, Risk Management, Fixed Income and Yield Curves (Part 4) (15:41)

-

StartTopic 1: Introduction to Portfolio Management, Risk Management, Fixed Income and Yield Curves (Part 5) (13:26)

-

StartTopic 2: Introduction to Your Excel Based Investment Portfolio Management System (17:00)

-

StartTopic 3: Portfolio & Risk Management, Stock, Bond, Commodities, REITs & Diversification Exercises (Part 1) (16:37)

-

StartTopic 3: Portfolio & Risk Management, Stock, Bond, Commodities, REITs & Diversification Exercises (Part 2) (19:16)

-

StartTopic 3: Portfolio & Risk Management, Stock, Bond, Commodities, REITs & Diversification Exercises (Part 3) (20:55)

-

StartTopic 3: Portfolio & Risk Management, Stock, Bond, Commodities, REITs & Diversification Exercises (Part 4) (22:20)

-

StartTopic 3: Portfolio & Risk Management, Stock, Bond, Commodities, REITs & Diversification Exercises (Part 5) (23:24)

-

StartTopic 3: Portfolio & Risk Management, Stock, Bond, Commodities, REITs & Diversification Exercises (Part 6) (27:11)

-

StartTopic 3: Portfolio & Risk Management, Stock, Bond, Commodities, REITs & Diversification Exercises (Part 7) (22:48)

-

Start[Optional Lecture]: Questions and Answers for FA 3-2 (Part 1) (18:06)

-

Start[Optional Lecture]: Questions and Answers for FA 3-2 (Part 2) (18:22)

-

StartQuiz for the Finance & Accounting Class #2 of Semester Three

-

StartWorkbook Attached for the Finance and Accounting Class #1 of Semester 4 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Understanding the Power of The Time Value of Money & Making Your Money Work for You (Part 1) (24:44)

-

StartTopic 1: Understanding the Power of The Time Value of Money & Making Your Money Work for You (Part 2) (13:47)

-

StartTopic 1: Understanding the Power of The Time Value of Money & Making Your Money Work for You (Part 3) (15:51)

-

StartTopic 2: 47 Ways to Save More Part 1: Savings Tips 1 to 24 (Part 1) (18:20)

-

StartTopic 2: 47 Ways to Save More Part 1: Savings Tips 1 to 24 (Part 2) (15:49)

-

StartTopic 3: 47 Ways to Save More Part 2: Savings Tips 25 to 47 (17:38)

-

Start[Optional Lecture]: Questions and Answers for FA 4-1 (23:57)

-

StartQuiz for the First Finance and Accounting Class of Semester Four

-

StartWorkbook Attached for the Finance and Accounting Class #2 of Semester 4 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Financial Research Steps #71 Through #80 (Includes Stock Details, Competition’s Valuation & Margins, Historical Growth) (Part 1) (16:03)

-

StartTopic 1: Financial Research Steps #71 Through #80 (Includes Stock Details, Competition’s Valuation & Margins, Historical Growth) (Part 2) (20:51)

-

StartTopic 1: Financial Research Steps #71 Through #80 (Includes Stock Details, Competition’s Valuation & Margins, Historical Growth) (Part 3) (22:09)

-

StartTopic 2: Financial Research Steps #81 Through #90 (Includes Revenue Forecast, Income Statement, Balance Sheet & Seasonality) (12:14)

-

StartTopic 3: Financial Research Steps #91 Through #100 (Includes Deferred Rev., P/E + P/R + DCF, Accounting Red Flags & Technicals) (Part 1) (20:47)

-

StartTopic 3: Financial Research Steps #91 Through #100 (Includes Deferred Rev., P/E + P/R + DCF, Accounting Red Flags & Technicals) (Part 2) (20:51)

-

Start[Optional Lecture]: Questions and Answers for FA 4-2 (23:53)

-

StartQuiz for the Second Finance and Accounting Class of Semester Four

-

StartWorkbook Attached for the Finance and Accounting Class #3 of Semester 4 in PDF, Microsoft Word and in Google Docs Format

-

StartTopic 1: Building Your 100-150 Page Comprehensive Microsoft Word Research Report, Which Includes All 100 Steps (35:11)

-

StartTopic 2: Building Your 1 Page PDF or Excel Research Report, Which Includes Highlights From All 100 Steps (14:47)

-

StartTopic 3: Optional Topic [No Quiz Questions on Topic 3]: Advanced Microsoft Excel Tips on How I Made the Spreadsheet (22:41)

-

StartQuiz for the Third Finance and Accounting Class of Semester Four

-

StartWorkbook Attached for the Optional Finance and Accounting Section in PDF, Microsoft Word and in Google Docs Format

-

StartIntroduction (1:28)

-

StartFinance and Accounting Resources (Part 1) (20:30)

-

StartFinance and Accounting Resources (Part 2) (14:37)

-

StartFinance and Accounting Resources (Part 3) (18:24)

-

StartFinance and Accounting Resources (Part 4) (23:48)

-

StartFinance and Accounting Resources (Part 5) (17:24)

-

StartFinance and Accounting Resources (Part 6) (21:19)

-

StartFinance and Accounting Resources (Part 7) (20:54)

-

StartFinance and Accounting Resources (Part 8) (20:19)

-

StartFinance and Accounting Resources (Part 9) (21:17)

-

StartFinance and Accounting Resources (Part 10) (24:40)

-

StartFinance and Accounting Resources (Part 11) (20:27)

-

StartFinance and Accounting Resources (Part 12) (22:32)

-

StartFinance and Accounting Resources (Part 13) (24:01)

-

StartFinance and Accounting Resources (Part 14) (20:33)

-

StartFinance and Accounting Resources (Part 15) (24:44)

-

StartFinance and Accounting Resources (Part 16) (20:48)

-

StartFinance and Accounting Resources (Part 17) (22:31)

-

StartFinance and Accounting Resources (Part 18) (25:42)

-

StartFinance and Accounting Resources (Part 19) (20:24)

-

StartFinance and Accounting Resources (Part 20) (18:52)

-

StartFinance and Accounting Resources (Part 21) (23:58)

-

Start[A] Introduction to Going Long and Going Short Stocks, ETFs, Commodities & More (2:02)

-

Start[A] Lecture 1.2.1: Going Long and Going Short Stocks, ETFs, Commodities & More (15:27)

-

Start[A] Exercise 1.2.1: Going Long a Stock (Also Called a Owning a Stock) (6:42)

-

Start[A] Exercise 1.2.2: Going Short a Stock (1:24)

-

Start[A] Exercise 1.2.3: Going Long a Country Based ETF (2:55)

-

Start[A] Exercise 1.2.4: Going Short a Country Based ETF (1:06)

-

Start[A] Exercise 1.2.5: Going Long a Sector Based ETF (2:21)

-

Start[A] Exercise 1.2.6: Going Short a Sector Based ETF (1:09)

-

Start[A] Exercise 1.2.7: Going Long a Commodity Based ETF (2:31)

-

Start[A] Exercise 1.2.8 Going Short a Commodity Based ETF (1:28)

-

Start[A] Quiz 1.2: Going Long and Going Short Stocks, ETFs, Commodities & More (0:58)

-

Start[B/A] Introduction to The Basics of How Options Work (Tickers,Calls,Puts & More) (3:21)

-

Start[B/A] Lecture 1.3.1: Calls are Easy to Learn if We Compare them to Insurance (8:10)

-

Start[B/A] Lecture 1.3.2: Option Leverage & Strike Prices and a BIG Surprise : ) (17:01)

-

Start[B/A] Lecture 1.3.3: Exercising Call Options for the Long Owner of a Call (1:34)

-

Start[B/A] Lecture 1.3.4: Introduction to Greek Formulas (8:04)

-

Start[B/A] Lecture 1.3.5: Intro. to Option Writing & Buying Our First Call Option (13:18)

-

Start[B/A] Lecture 1.3.6: Selling and Exercising Our First Long Call Option (5:10)

-

Start[B/A] Lecture 1.3.7: Writing (Shorting) Our First Call Option & Assignment Risk (11:12)

-

Start[B/A] Lecture 1.3.8: Buying (Meaning Going Long) Our First Put Option (5:44)

-

Start[B/A] Lecture 1.3.9: Selling and Exercising Our First Long Put Option (2:09)

-

Start[B/A] Lecture 1.3.10: Writing (Shorting) Our First Put Option & Assignment Risk (4:00)

-

Start[B/A] Lecture 1.3.11: How to Read Option Tickers (1:26)

-

Start[B/A] Exercise 1.3.1: How to Read Option Tickers (1:53)

-

Start[B/A] Exercise 1.3.2: How Do We Value a Call (Plus Volatility & Dividends)? Pt 1 (13:03)

-

Start[B/A] Exercise 1.3.2: How Do We Value a Call (Plus Volatility & Dividends)? Pt 2

-

Start[B/A] Exercise 1.3.3: How Much Can We Make or Lose When We’re Long a Call Option (5:40)

-

Start[B/A] Exercise 1.3.4: Comparing Profits & Losses for Owning a Stock Vs. a Call (5:34)

-

Start[B/A] Exercise 1.3.5: What is a Put Option and How Do We Value a Put Option? (9:19)

-

Start[B/A] Exercise 1.3.6: How Much Can We Make or Lose When Buying a Put Option? (3:21)

-

Start[B/A] Exercise 1.3.7: Comparing Profits & Losses for Short Stock Vs. Long a Put (5:44)

-

Start[B/A] Exercise 1.3.8: What’s a Short Call & How Do We Value a Short Call? (9:53)

-

Start[B/A] Exercise 1.3.9: How Much Can We Make or Lose When Shorting a Call Option? (2:54)

-

Start[B/A] Exercise 1.3.10: What’s a Short Put & How Do We Value a Short Put? (7:25)

-

Start[B/A] Exercise 1.3.11: How Much Can We Make or Lose When Shorting a Put Option? (3:01)

-

Start[B/A] Quiz 1.3: The Basics of How Options Work (Tickers, Calls, Puts & More) (0:54)

-

Start[A] Optional Side Note: Opening an Options Account and Using Options Software (12:10)

-

Start[B/A] Introduction to Pricing a Long or Short Call or Put (3:51)

-

Start[B/A] Lecture 1.4.1: Understanding Historical Versus Implied Volatility Pt 1 (9:58)

-

Start[B/A] Lecture 1.4.1: Understanding Historical Versus Implied Volatility Pt 2 (11:05)

-

Start[B/A] Lecture 1.4.2: Understanding Open Interest and Volume (4:09)

-

Start[B/A] Lecture 1.4.3: Options Best Practices Pt 1 (10:36)

-

Start[B/A] Lecture 1.4.3: Options Best Practices Pt 2 (12:31)

-

Start[B/A] Exercise 1.4.1: Detailed Analysis of Pricing a Long Call Option Pt 1 (15:26)

-

Start[B/A] Exercise 1.4.1: Detailed Analysis of Pricing a Long Call Option Pt 2 (5:46)

-

Start[B/A] Exercise 1.4.2: Detailed Analysis of Pricing a Long Put Option (13:40)

-

Start[B/A] Exercise 1.4.3: Detailed Analysis of Pricing a Short Call Option (9:31)

-

Start[B/A] Exercise 1.4.4: Detailed Analysis of Pricing a Short Put Option (3:54)

-

Start[B/A] Exercise 1.4.5: Your Automated Option Strategy 1 Page Print/PDF Report (6:06)

-

Start[B/A] Quiz 1.4: Pricing a Long or Short Call or Put (0:38)

-

Start[A] Optional Side Note: What Are Futures (Another Derivative Product)? (18:01)

-

Start[B/G/A] Lecture 2.1.1: Protecting [Hedging] Your House & Risk Management Pt 1 (7:50)

-

Start[B/G/A] Lecture 2.1.1: Protecting [Hedging] Your House & Risk Management Pt 2 (12:45)

-

Start[B/G/A] Lecture 2.1.2: Statistics & Historical and Implied Volatility (10:03)

-

Start[B/G/A] Lecture 2.1.3: “AB-Normal” Distribution and Volatility to Predict Prices (15:14)

-

Start[B/G/A] Lecture 2.1.4: Detailed Description of Greek Formulas for Options Pt 1 (13:24)

-

Start[B/G/A] Lecture 2.1.4: Detailed Description of Greek Formulas for Options Pt 2 (18:10)

-

Start[B/G/A] Exercise 2.1.1: Statistics and Greek Formulas to Analyze Options (2:49)

-

Start[B/G/A] Quiz 2.1: Statistics and Greek Formulas to Analyze Options (1:04)

-

Start[B/G/A] Lecture 2.2.1: Intro to How to Value Options Using Binomial Pricing (5:23)

-

Start[B/G/A] Lecture 2.2.2:Using a Basic 4 Branch Model to Estimate Call Option Price (16:37)

-

Start[B/G/A] Lecture 2.2.3: How Does Binomial Pricing Work? (14:52)

-

Start[B/G/A] Exercise 2.2.1: How to Value Calls Using a Basic 4 Step Decision Tree (1:06)

-

Start[B/G/A] Exercise 2.2.2: How to Value Options Using Binomial Pricing (0:56)

-

Start[A] Optional Side Note: Make Tough Decisions Using Probabilities (5:51)

-

Start[A] Optional Side Note: How the Best Hedge Fund Uses Software to Make 60%/Year (5:24)

-

Start[B/G/A] Quiz 2.2: How to Value Options Using Binomial Pricing (0:40)

-

Start[G/A] Lecture 2.3.1: How to Value Options Using Black Scholes (3:39)

-

Start[G/A] Exercise 2.3.1: How to Value Options Using Black Scholes (0:42)

-

Start[G/A] Quiz 2.3: How to Value Options Using Black Scholes (0:44)

-

Start[A] Optional Side Note: What are Forwards (Another Derivative Product) (1:33)

-

Start[G/A] Lecture 2.4.1: How to Value Options Using Monte Carlo Simulation (15:58)

-

Start[G/A] Exercise 2.4.1: How to Value Options Using Monte Carlo Simulation (0:41)

-

Start[G/A] Quiz 2.4: How to Value Options Using Monte Carlo Simulation (0:40)

-

Start[A] Side Note: What Are Swaps? (Another Derivatives Product) (3:53)

-

Start[B/G/A] Lecture 3.1.1: Creating the Long Call Options Strategy (7:01)

-

Start[B/G/A] Exercise 3.1.1: Creating the Long Call Option Strategy (12:25)

-

Start[B/G/A] Lecture 3.1.2: Creating the LEAPS Call Option Strategy (3:33)

-

Start[B/G/A] Exercise 3.1.2: Creating the LEAPS Call Option Strategy (4:39)

-

Start[B/G/A] Lecture 3.1.3: Creating the Long Put Option Strategy (4:10)

-

Start[B/G/A] Exercise 3.1.3: Creating the Long Put Option Strategy (7:58)

-

Start[B/G/A] Lecture 3.1.4: Creating the LEAPS Put Option Strategy (2:42)

-

Start[B/G/A] Exercise 3.1.4: Creating the LEAPS Put Option Strategy (6:55)

-

Start[B/G/A] Lecture 3.1.5: Creating the Short Call Option Strategy (6:33)

-

Start[B/G/A] Exercise 3.1.5: Creating the Short Call Option Strategy (6:32)

-

Start[B/G/A] Lecture 3.1.6: Creating the Short Put Option Strategy (3:36)

-

Start[B/G/A] Exercise 3.1.6: Creating the Short Put Option Strategy (5:24)

-

Start[B/G/A] Lecture 3.1.7: Creating the Cash Secured Put Option Strategy (3:35)

-

Start[B/G/A] Exercise 3.1.7: Creating the Cash Secured Put Option Strategy (1:22)

-

Start[B/G/A] Lecture 3.1.8: Creating Other Single Option Strategies (0:54)

-

Start[B/G/A] Exercise 3.1.8: Creating Other Single Options Strategies (0:43)

-

Start[A] Optional Side Note: Fundamental Investment Analysis (12:35)

-

Start[A] Optional Side Note: Catalyst Based Investment Analysis (3:09)

-

Start[A] Optional Side Note: Technical Analysis Based Investment Analysis (7:48)

-

Start[B/G/A] Quiz 3.1: Creating Single Option Strategies (0:52)

-

Start[B/G/A] Lecture 3.2.0: Intro. to Creating 1 Stock PLUS Single Option Strategies (0:49)

-

Start[B/G/A] Lecture 3.2.1: Creating the Married Put Option Strategy (4:45)

-

Start[B/G/A] Exercise 3.2.1: Creating the Married Put Option Strategy (9:40)

-

Start[B/G/A] Lecture 3.2.2: Creating the Covered Call Option Strategy (5:09)

-

Start[B/G/A] Exercise 3.2.2: Creating the Covered Call Option Strategy (6:40)

-

Start[B/G/A] Lecture 3.2.3: Creating Other 1 Stock + Single Option Strategies (0:34)

-

Start[B/G/A] Exercise 3.2.3: Creating Other 1 Stock + Single Option Strategies (0:41)

-

Start[B/G/A] Quiz 3.2: Creating 1 Stock PLUS Single Option Strategies (0:48)

-

Start[B/G/A] Lecture 3.3.0: Introduction to Creating Two Options Strategies (4:38)

-

Start[B/G/A] Lecture 3.3.1: Creating the Long Straddle Options Strategy (5:59)

-

Start[B/G/A] Exercise 3.3.1: Creating the Long Straddle Option Strategy (13:25)

-

Start[B/G/A] Lecture 3.3.2: Creating the Short Straddle Option Strategy (5:00)

-

Start[B/G/A] Exercise 3.3.2: Creating the Short Straddle Option Strategy (4:28)

-

Start[B/G/A] Lecture 3.3.3: Creating the Long Strangle Option Strategy (5:44)

-

Start[B/G/A] Exercise 3.3.3: Creating the Long Strangle Option Strategy (7:43)

-

Start[B/G/A] Lecture 3.3.4: Creating the Short Strangle Option Strategy (4:28)

-

Start[B/G/A] Exercise 3.3.4: Creating the Short Strangle Option Strategy (3:26)

-

Start[B/G/A] Lecture 3.3.5: Creating the Bull Call Spread Option Strategy (4:54)

-

Start[B/G/A] Exercise 3.3.5: Creating the Bull Call Spread Option Strategy (8:20)

-

Start[B/G/A] Lecture 3.3.6: Creating the Bear Call Spread Option Strategy (3:49)

-

Start[B/G/A] Exercise 3.3.6: Creating the Bear Call Spread Option Strategy (4:07)

-

Start[B/G/A] Lecture 3.3.7: Creating the Bear Put Spread Option Strategy (4:30)

-

Start[B/G/A] Exercise 3.3.7: Creating the Bear Put Spread Option Strategy (3:18)

-

Start[B/G/A] Lecture 3.3.8: Creating the Bull Put Spread Option Strategy (3:21)

-

Start[B/G/A] Exercise 3.3.8: Creating the Bull Put Spread Option Strategy (2:25)

-

Start[B/G/A] Lecture 3.3.9: Creating the Synthetic Long Option Strategy (3:06)

-

Start[B/G/A] Exercise 3.3.9: Creating the Synthetic Long Option Strategy (2:51)

-

Start[B/G/A] Lecture 3.3.10: Creating the Synthetic Short Option Strategy (3:27)

-

Start[B/G/A] Exercise 3.3.10: Creating the Synthetic Short Option Strategy (2:34)

-

Start[B/G/A] Lecture 3.3.11: Creating the Collar Option Strategy (3:15)

-

Start[B/G/A] Exercise 3.3.11: Creating the Collar Option Strategy (4:03)

-

Start[B/G/A] Lecture 3.3.12: Creating Fig Leaf Option Strategy (3:29)

-

Start[B/G/A] Exercise 3.3.12: Creating Fig Leaf Option Strategy (4:21)

-

Start[B/G/A] Lecture 3.3.13: Creating Other Two Option Strategies (0:38)

-

Start[B/G/A] Exercise 3.3.13: Creating Other Two Options Strategies (0:38)

-

Start[B/G/A] Quiz 3.3: Creating Two Options Strategies (1:00)

-

Start[G/A] Lecture 3.4.0: Introduction to Creating the Four Options Strategy (13:09)

-

Start[G/A] Lecture 3.4.1: Creating the Short Iron Condor Options Strategy (6:38)

-

Start[G/A] Exercise 3.4.1: Creating the Short Iron Condor Option Strategy Pt 1 (6:34)

-

Start[G/A] Exercise 3.4.1: Creating the Short Iron Condor Option Strategy Pt 2 (14:00)

-

Start[G/A] Lecture 3.4.2: Creating the Long Iron Condor Option Strategy (5:46)

-

Start[G/A] Exercise 3.4.2: Creating the Long Iron Condor Option Strategy (6:15)

-

Start[G/A] Lecture 3.4.3: Creating the Long Condor Spread with Calls Option Strategy (6:23)

-

Start[G/A] Exercise 3.4.3: Creating the Long Condor Spread with Calls Option Strategy (5:41)

-

Start[G/A] Lecture 3.4.4: Creating the Long Condor Spread with Puts Option Strategy (3:19)

-

Start[G/A] Exercise 3.4.4: Creating the Long Condor Spread with Puts Option Strategy (3:03)

-

Start[G/A] Lecture 3.4.5: Creating the Short Iron Butterfly Option Strategy (3:17)

-

Start[G/A] Exercise 3.4.5: Creating the Short Iron Butterfly Option Strategy (9:04)

-

Start[G/A] Lecture 3.4.6: Creating the Long Iron Butterfly Option Strategy (3:20)

-

Start[G/A] Exercise 3.4.6: Creating the Long Iron Butterfly Option Strategy (3:16)

-

Start[G/A] Lecture 3.4.7: Creating the Butterfly Spread with Calls Option Strategy (2:42)

-

Start[G/A] Exercise 3.4.7: Creating the Butterfly Spread with Calls Option Strategy (4:17)

-

Start[G/A] Lecture 3.4.8: Creating the Butterfly Spread with Puts Option Strategy (2:55)

-

Start[G/A] Exercise 3.4.8: Creating the Butterfly Spread with Puts Option Strategy (4:21)

-

Start[G/A] Lecture 3.4.9: Creating Long Inverse Skip Butterfly with Calls Strategy (6:19)

-

Start[G/A] Exercise 3.4.9: Creating Long Inverse Skip Butterfly with Calls Strategy (9:41)

-

Start[G/A] Lecture 3.4.10: Creating Long Inverse Skip Butterfly with Puts Strategy (4:57)

-

Start[G/A] Exercise 3.4.10: Creating Long Inverse Skip Butterfly with Puts Strategy (7:04)

-

Start[G/A] Lecture 3.4.11: Creating Long a Skip Strike Butterfly with Calls Strategy (3:12)

-

Start[G/A] Exercise 3.4.11: Creating Long a Skip Strike Butterfly with Calls Strategy (6:33)

-

Start[G/A] Lecture 3.4.12: Creating Long a Skip Strike Butterfly with Puts Strategy (2:38)

-

Start[G/A] Exercise 3.4.12: Creating Long a Skip Strike Butterfly with Puts Strategy (7:06)

-

Start[G/A] Lecture 3.4.13: Creating Other Four Option Strategies (0:55)

-

Start[G/A] Exercise 3.4.13: Creating Other Four Options Strategies (0:34)

-

Start[G/A] Quiz 3.4: Creating the Four Options Strategy (0:55)

-

Start[G/A] Lecture 3.5.0: Introduction to Creating the Three Options Strategies (3:28)

-

Start[G/A] Lecture 3.5.1: Creating the Back Spread with Calls Options Strategy (3:59)

-

Start[G/A] Exercise 3.5.1: Creating the Back Spread with Calls Option Strategy (12:52)

-

Start[G/A] Lecture 3.5.2: Creating the Back Spread with Puts Option Strategy (2:48)

-

Start[G/A] Exercise 3.5.2: Creating the Back Spread with Puts Option Strategy (8:07)

-

Start[G/A] Lecture 3.5.3: Creating the Front Spread with Calls Option Strategy (2:20)

-

Start[G/A] Exercise 3.5.3: Creating the Front Spread with Calls Option Strategy (5:26)

-

Start[G/A] Lecture 3.5.4: Creating the Front Spread with Puts Option Strategy (1:37)

-

Start[G/A] Exercise 3.5.4: Creating the Front Spread with Puts Option Strategy (5:03)

-

Start[G/A] Lecture 3.5.5: Creating Other Three Option Strategies (0:38)

-

Start[G/A] Exercise 3.5.5: Creating Other Three Options Strategies (0:42)

-

Start[G/A] Quiz 3.5: Creating Three Options Strategies (0:47)

-

StartAlpha (2:55)

-

StartAmerican Versus European Style Options (2:12)

-

StartAt The Money [ATM] (1:27)

-

StartBack Spread with Calls Option Strategy (Uses 3 Options) (3:45)

-

StartBack Spread with Puts Option Strategy (Uses 3 Options) (2:22)

-

StartBear Call Spread Option Strategy (Uses 2 Options) (3:40)

-

StartBear Put Spread Option Strategy (Uses 2 Options) (4:20)

-

StartBearish (1:22)

-

StartBeta (2:53)

-

StartBid Ask (2:09)

-

StartBinomial Option Valuation (2:58)

-

StartBlack-Scholes Option Valuation (1:12)

-

StartBroken Wing Option Strategy (Uses 4 Options) (2:49)

-

StartBull Call Spread Option Strategy (Uses 2 Options) (4:43)

-

StartBull Put Spread Option Strategy (Uses 2 Options) (3:13)

-

StartBullish (1:22)

-

StartButterfly Spread with Calls Option Strategy (Uses 4 Options) (2:24)

-

StartButterfly Spread with Puts Option Strategy (Uses 4 Options) (2:26)

-

StartBuy to Close (0:43)

-

StartBuy to Open (0:43)

-

StartCall Option (7:13)

-

StartCall or Put (7:13)

-

StartCash Secured Put Option Strategy (Uses 1 Option) (3:24)

-

StartCatalyst (2:27)

-

StartCBOE (1:57)

-

StartCollar Option Strategy (Uses 2 Options) (3:03)

-

StartCondor Spread with Calls Option Strategy (Uses 4 Options) (5:51)

-

StartCondor Spread with Puts Option Strategy (Uses 4 Options) (2:54)

-

StartCovered Call Option Strategy (Uses 1 Option and 1 Stock) (5:01)

-

StartCredit Call Spread Option Strategy (Uses 2 Options) (3:40)

-

StartCredit Put Spread Option Strategy (Uses 2 Options) (3:13)

-

StartDebit Call Spread Option Strategy (Uses 2 Options) (4:43)

-

StartDebit Put Spread Option Strategy (Uses 2 Options) (4:20)

-

StartDelta (1:17)

-

StartDerivative (1:58)

-

StartETF (15:47)

-

StartExercising Option (1:21)

-

StartExpiration Date (2:43)

-

StartExtrinsic (1:03)

-

StartFig Leaf Option Strategy (Uses 2 Options) (3:12)

-

StartForwards (1:33)

-

StartFront Spread with Calls Option Strategy (Uses 3 Options) (1:53)

-

StartFront Spread with Puts Option Strategy (Uses 3 Options) (1:27)

-

StartFundamental Investment Analysis (12:35)

-

StartFutures (18:01)

-

StartGamma (1:28)

-

StartGreek Formulas (3:00)

-

StartHedging (5:20)

-

StartHistorical Volatility (9:58)

-

StartHow to Navigate the Spreadsheets (18:35)

-

StartImplied Volatility (9:58)

-

StartIn The Money [ITM] (1:27)

-

StartInstructions for Tab 1.1 (3:39)

-

StartInstructions for Tab 1.2 (1:41)

-

StartInstructions for Tab 1.3 (1:34)

-

StartInstructions for Tab 1.4 (0:57)

-

StartInstructions for Tab 2.1 (1:41)

-

StartInstructions for Tab 2.2 (1:45)

-

StartInstructions for Tab 2.3 (0:56)

-

StartInstructions for Tab 2.4 (0:54)

-

StartInstructions for Tab 3.1 (3:00)

-

StartInstructions for Tab 3.2 (1:41)

-

StartInstructions for Tab 3.3 (4:07)

-

StartInstructions for Tab 3.4 (7:51)

-

StartInstructions for Tab 3.5 (4:28)

-

StartInterest Rate (1:47)

-

StartIntrinsic (1:03)

-

StartInverse Broken Wing Butterfly Option Strategy with Calls (Uses 4 Options) (5:54)

-

StartInverse Broken Wing Butterfly Option Strategy with Puts (Uses 4 Options) (4:35)

-

StartInverse Skip Butterfly with Calls Option Strategy (Uses 4 Options) (5:54)

-

StartInverse Skip Butterfly with Puts Option Strategy (Uses 4 Options) (4:35)

-

StartInverse Split Strike Butterfly Option Strategy for Calls (Uses 4 Options) (5:54)

-

StartInverse Split Strike Butterfly Option Strategy for Puts (Uses 4 Options) (4:35)

-

StartIron Butterfly (Buying) Option Strategy (Uses 4 Options) (2:32)

-

StartIron Butterfly (Selling) Option Strategy (Uses 4 Options) (3:00)

-

StartIron Condor (Buying) Option Strategy (Uses 4 Options) (4:44)

-

StartIron Condor (Selling) Option Strategy (Uses 4 Options) (6:30)

-

StartLEAPs Call Option Strategy (Uses 1 Option) (3:20)

-

StartLEAPs Diagonal Spread Option Strategy (Uses 2 Options) (3:12)

-

StartLEAPs Put Option Strategy (Uses 1 Option) (2:31)

-

StartLeveraged Covered Call Option Strategy (Uses 2 Options) (3:12)

-

StartLong Call Option Strategy (Uses 1 Option) (5:59)

-

StartLong Call Spread Option Strategy (Uses 2 Options) (4:43)

-

StartLong Combination Option Strategy (Uses 2 Options) (2:55)

-

StartLong Combo Option Strategy (Uses 2 Options) (2:55)

-

StartLong (4:47)

-

StartLong Put Option Strategy (Uses 1 Option) (3:59)

-

StartLong Put Spread Option Strategy (Uses 2 Options) (4:20)

-

StartLong Straddle Option Strategy (Uses 2 Options) (5:30)

-

StartLong Strangle Option Strategy (Uses 2 Options) (5:36)

-

StartMargin (2:55)

-

StartMarket Order (2:48)

-

StartMarried Put Option Strategy (Uses 1 Option and 1 Stock. Also called a Protective (4:34)

-

StartMonte Carlo Simulation Option Valuation (5:00)

-

StartMultiplier (1:56)

-

StartNaked Call Option Strategy (Uses 1 Option) (6:18)

-

StartNaked Put Option Strategy (Uses 1 Option) (3:31)

-

StartNormal Distribution (6:46)

-

StartOpen Interest (3:24)

-

StartOption Chain (1:04)

-

StartOption Clearing Corporation (0:26)

-

StartOption Inputs (2:16)

-

StartOption Price (1:47)

-

StartOptions Exchanges (1:10)

-

StartOut of the Money [OTM] (1:27)

-

StartPay Later Call Option Strategy (Uses 3 Options) (3:45)

-

StartPay Later Put Option Strategy (Uses 3 Options) (2:22)

-

StartProtective Collar Option Strategy (Uses 2 Options) (3:03)

-

StartProtective Put Option Strategy (Uses 1 Option and 1 Stock) (4:34)

-

StartPut Option (7:13)

-

StartRatio Vertical Spread Option Strategy (Uses 3 Options) (1:53)

-

StartRatio Volatility Spread Option Strategy (Uses 3 Options) (3:45)

-

StartRho (1:40)

-

StartRisk Management (6:38)

-

StartSell to Close (0:43)

-

StartSell to Open (0:43)

-

StartSelling Options (4:44)

-

StartShort Call Option Strategy (Uses 1 Option) (6:18)

-

StartShort Call Spread Option Strategy (Uses 2 Options) (3:40)

-

StartShort Combination Option Strategy (Uses 2 Options) (3:03)

-

StartShort (4:44)

-

StartShort Put Option Strategy (Uses 1 Option) (3:31)

-

StartShort Put Spread Option Strategy (Uses 2 Options) (3:13)

-

StartShort Straddle Option Strategy (Uses 2 Options) (4:31)

-

StartShorting Options (4:44)

-

StartSkip Strike Butterfly with Calls Option Strategy (Uses 4 Options) (2:49)

-

StartSkip Strike Butterfly with Puts Option Strategy (Uses 4 Options) (2:23)

-

StartStrike Price (2:05)

-

StartSwaps (3:53)

-

StartSynthetic Long Stock Option Strategy (Uses 2 Options) (2:55)

-

StartSynthetic Short Stock Option Strategy (Uses 2 Options) (3:03)

-

StartTechnical Analysis (7:48)

-

StartTheta (0:31)

-

StartTime Decay (0:27)

-

StartUncovered Call Option Strategy (Uses 1 Option) (6:18)

-

StartUncovered Put Option Strategy (Uses 1 Option) (3:31)

-

StartUnderlying (0:23)

-

StartValuation Based Investment Analysis (10:21)

-

StartVega (0:31)

-

StartVertical Spread Option Strategy (Uses 2 Options) (3:40)

-

StartVix (5:15)

-

StartVolatility (9:58)

-

StartVolume (3:24)

-

StartWriting Options (4:44)

-

Start[A] Intro to How I Created the Excel Spreadsheets Without Any Code or Macros (1:26)

-

Start[A] How to Create the Buttons and Menu at the Top of Your Excel Dashboard (20:47)

-

Start[A] How to Make Check Boxes (9:20)

-

Start[A] How to Make Option Controls (Radio Controls) in Excel (6:52)

-

Start[A] How to Filter Data and Using "APIs" or Customized Internet Links (10:24)

-

Start[A] Aligning Images, Naming Cells, Linking CSV Content, Charts & Data Formatting (17:07)

-

Start[A] Image Formatting and Resizing Options with Grouped Cells & Spinners (7:13)

-

Start[A] Creating the Ticker Array, Asset Classes & Formulas Using Named Ranges (14:29)

-

Start[A] Charting Options (Based on Data in Hidden Tabs) (3:21)

-

Start[A] Creating Reports Using Check Boxes and Named Ranges (7:54)

-

Start[A] Conditional Formatting, Green Screen & Excel, Monte Carlo Sim. & Random #s (12:29)

-

Start[A] Making the Progress Tab & Adding Arrays to the Reports (12:36)